Balanced Scorecard for Consolidators

As veterinary consolidation becomes more common and more competitive, consolidators need practical tools and resources to value practice and accurately structure an acceptable deal.

There are many tests and metrics available to assess a business’s value, but to scale viable consolidations, standardized practices should be implemented.

Enter the balanced scorecard (BSC)

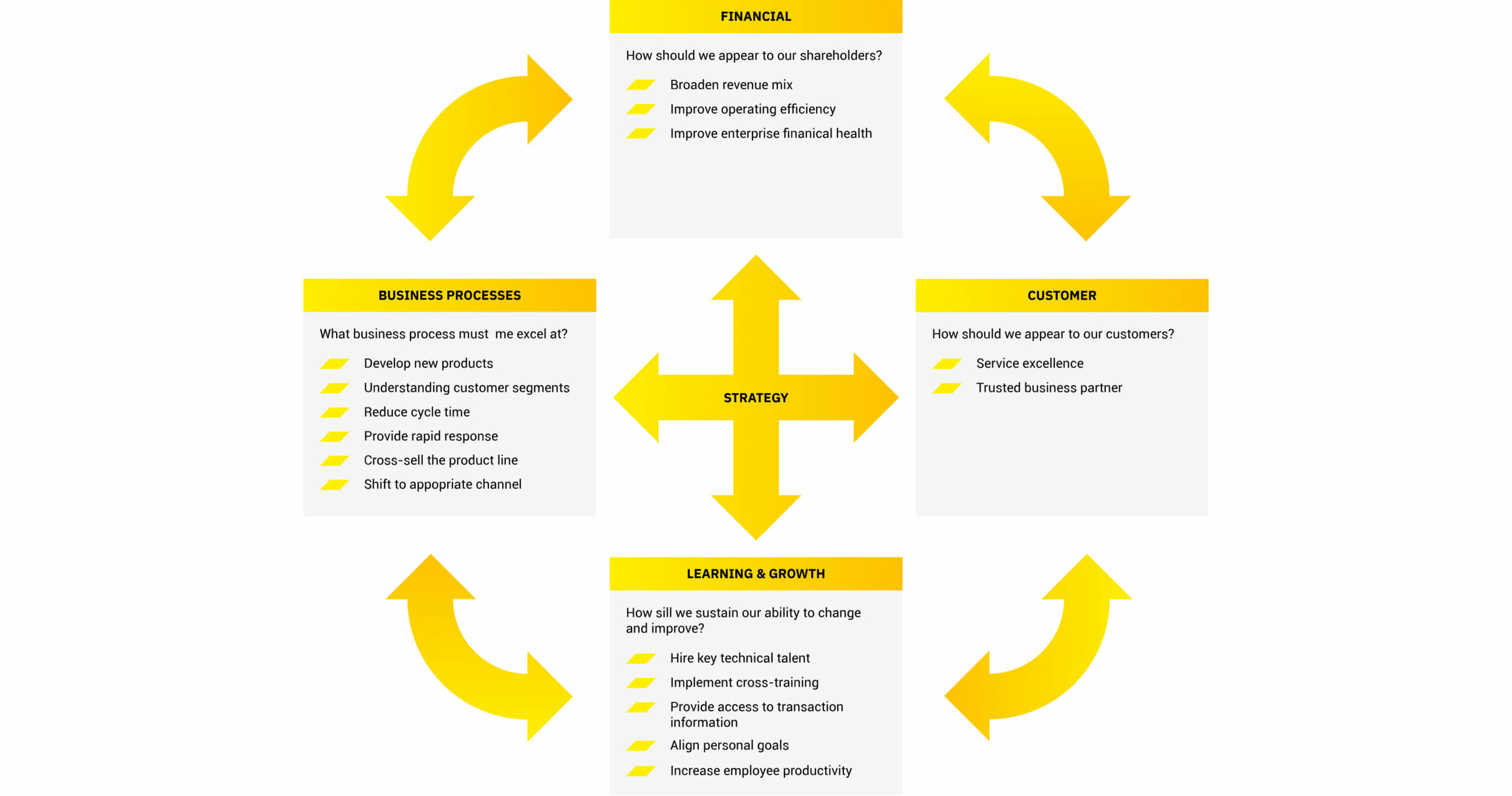

The balanced scorecard is a unique and comprehensive business strategy developed to create a detailed representation of an enterprise.

The balanced scorecard combines financial data, internal business processes, customer data, and more to assist consolidators and business strategists in identifying pain points and areas of improvement. On the flip side, it highlights which strategies are working well in the current model.

There are balanced scorecard templates available for various uses, including for veterinary practices.

In this article, we will go through balanced card examples and how they relate to consolidating veterinary practices.

What is a Balanced Scorecard System?

The balanced scorecard Is a unique scoring system for measuring the overall performance and viability of a business.

It was introduced in 1992 by David Norton and Robert Kaplan. Since its introduction, it has continuously evolved and been implemented by companies all over the world.

The Balanced Scorecard’s primary goal is to evaluate internal and external components of a business, such as its strategies, employee knowledge, and public perception.

By gathering large amounts of data and compiling it into four primary categories, decision-makers will discover the practice’s weak spots, improve them, and introduce tactics that yield positive results:

Learning and Growth

The balanced scorecard’s learning and growth component digs into the operational excellence of employee training, education, and application of their institutional knowledge.

For a business to develop a competitive advantage over its competition, its team members need to be up to speed on best practices and competent in adapting to the new policies and procedures.

Depending on how this section is scored, it will tell business leaders and consolidators how well the employees receive information from their superiors and if their application enhances its competitive advantage.

Internal Business Processes

The internal business processes range from developing strategies to management’s ability to create efficiencies.

Management in a veterinary practice must be aware of bottlenecks and supply shortages that can hinder performance.

For example, if a clinic is consistently depleting its supply of rabies vaccines, this portion of the balanced scorecard would highlight the depletion and signal to management to increase their inventory.

Customer Knowledge

External metrics are critical for leadership and consolidators because they provide perspective and shed light on the public’s perception of the business.

Surveys, interviews, and other client feedback tools provide valuable information about the level of care provided by the vets, how comfortable clients and patients are in the office, and the overall rating of the practice by the average customer.

If a practice is doing well in this area, the balanced scorecard will indicate that they should stay the course with what they are doing and provide small tweaks to enhance the customer experience.

On the other hand, this step may reveal that the practice has a negative public perception and should incentivize management to immediately improve clients’ and patients’ experience.

Financial Performance

Metrics such as revenue, expenses, and profitability all tie into the financial performance of the practice.

Investors and potential buyers are usually the most interested in how a company is performing financially when they are considering buying it.

Why is a BSC Applicable to Veterinary Consolidation?

As the trajectory of consolidations continues to explode in the veterinary space, it is more important than ever for consolidators to be able to assign tangible metrics to assess the business performance in the 4 areas listed above. Measuring metrics that matter helps an organization to keep track of business performance as well as outside influences.

Every veterinary practice has its own culture, internal processes, exam codes, billing procedures, etc. As the veterinary group, it is your job to identify what data is available, what is important to measure, and how that information can be standardized to provide a trustworthy holistic system for managing strategy.

In looking at the 4 aspects specifically for veterinary consolidations, some examples of the internal metrics that might be collected, include:

- Financial – cash flow, operating income, cost of goods, appointment volume, net profit;

- Customer – net promoter score, ratio of return visits;

- Internal Business Process – ERP, CRM, PMS, unit costs, error rates;

- Learning and Growth – retention rates, employee engagement scores, training for staff.

Without a holistic approach, you could be sacrificing one or more of the BSC areas and risk losing customers, technicians, or even the veterinarians themselves, resulting in roadblocks for continued expansion.

As a consolidator, wouldn’t it be great if you could track and monitor business performance using simple dashboards and generate reports so that issues could be identified and action-steps put in place to resolve problems quickly?

How to Design a BSC for a Veterinary Group?

The best way to design a Veterinary Business Scorecard is by using a template. We’ve provided some basic sample templates for you below. Here are the key components to include as you build your BSC (source).

Determine the vision. The vision is the heart of the balanced scorecard. No matter what aspect of the company you look at, the company’s goal or vision should always be front and center. We highly recommend using the Value Creation Plan framework to make it specific and clear as opposed to fluffy and generic.

Add the BSC Perspectives. Learning and Growth, Internal Processes, Customers, and Financial Performance.

Add objectives and measures. Within each perspective, define specific objectives, measures, targets, and initiatives.

Connect each piece. Link each perspective to the others using arrows to indicate that they’re all interconnected when achieving the company’s overall vision.

Share and communicate. Use the balanced scorecard to demonstrate how different initiatives and short-term actions are contributing to the long-term strategic objects of the company.

Example of Balanced Scorecard Template for You to Start

Download a BSC Template:

Application for Your Business

Although the balanced scorecard may seem intimidating at first, it provides exceptional data that business leaders can use, analyze, and ultimately apply to their strategy.

Another advantage of the balanced scorecard is the blending of tactical business data with financial performance and metrics.

As we discussed, financial data paints one component of the enterprise picture, but it doesn’t reveal everything that is going on within the business. This is the beauty of the balanced scorecard.

By utilizing financial data, cultural aspects of your practice, and customer relationships, the business owner and the consolidators have robust data to analyze your practice.

Consolidations in the veterinary market are becoming more common. Suppose you want to prepare your practice for a successful consolidation. In that case, the balanced scorecard model provides an excellent framework for identifying weak spots in your business model and tools to implement improvements.

If you have questions about how your practice can fit into an accretive consolidation, this chart provides an excellent visual reference.